MGR eCommerce Edge Weekly | February 18, 2020

Top News This Week

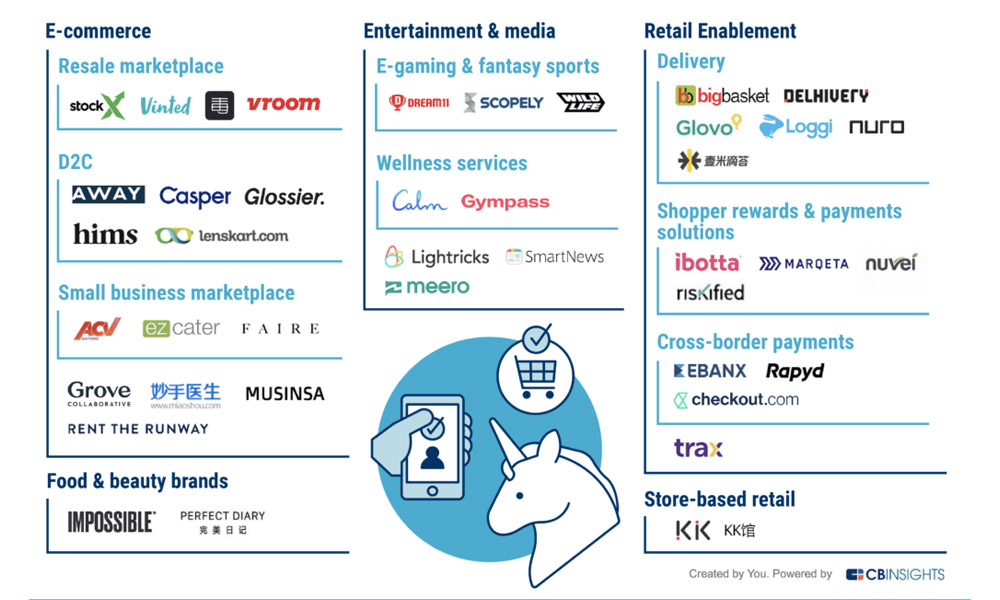

Consumer companies that joined the unicorn club in 2019 via CB Insights.

VC Money is Leaving DTC, and It’s Probably Good for Both Sides

In 2018 alone DTC companies raised over $1 Billion from VCs. We likely won’t see fundraising numbers like that again for consumer product companies for a long time. (CB Insights)

But that’s okay, in fact it might even be great news.

The VC model is one that works phenomenally well for tech and other industries where scale is virtually unlimited and gross margins are 90%+. However, in industries where scaling is very much an incredible challenge and gross margins are much lower, such as physical consumer goods, the VC model breaks.

When VCs invest in a software company, they do so with the belief that said company can go from 0 to $1 Billion valuation in 5 years or less (typically to achieve that valuation a software company needs $100 Million in revenue but it varies a lot based on growth rates).

To go from $0 to $100 million in revenue in five years or less selling physical goods is nearly impossible. The only way to do it has been to take on a bunch of capital from VCs and burn through it like firewood on cold winter’s night.

But this leads to a lack of capital discipline and a push from VCs to keep growing at all costs. This difference in operational efficiency due to cash constraints can be seen clearly between Casper and Purple. They both are fast growing mattress brands, but despite Purple generating less revenue, they finished 2019 with an EBITDA of $27.7M, meanwhile Capser lost $53.8M.

Revenue in software is an incredibly strong indicator of success because it is inherently very high margin. Revenue selling physical goods means much less. This is why the VC model of growing top line revenue at all costs breaks with physical goods.

Throwing more money at start ups is not the solver of all problems, in fact capital constraint leads to higher levels of discipline and forces companies to achieve product-market fit (PMF) much faster. If a non-funded company fails to find PMF they likely won’t make it past 18-24 months.

It’s never been better to be a primarily DTC focused brand, but that doesn’t mean that simply being one is anywhere close to guaranteeing success.

The companies that come out on top over the next five years will be mostly bootstrapped and “half-strapped” companies as I like to call them. “Half-strapped” is a company that raises money initially to give them a big boost but is disciplined enough to become profitable in order to avoid playing the VC game of always trying to make it to the next round.

These two archetypes will prove enduring, while most high-velocity VC backed DTC brands will either fail or face reality with serious down rounds.

This cycle will build on itself in two ways:

• The massive marketing budgets of VC backed brands will get slashed meaning less money to bid up the Facebook and Google auctions, lowering (or at least slowing) the currently rising CAC for brands.

• As more VC backed brands prove to be bad investments, even less VC money will come in, leveling the playing field and making it so that only the most efficient and prudent operators win.

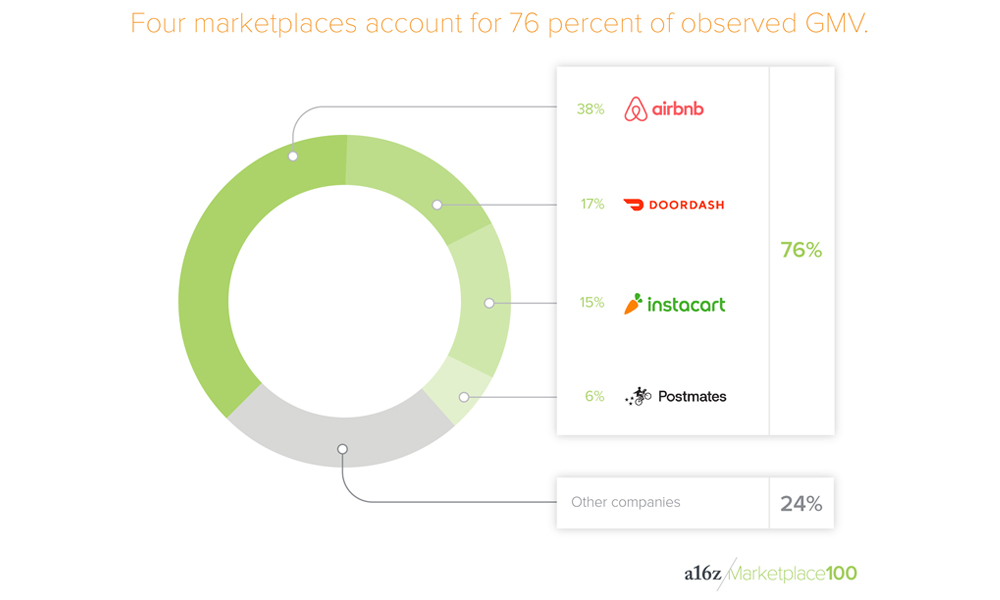

a16z Releases the Marketplace 100: The Top 100 Largest and Fastest Growing Marketplace Startups

A few takeaways:

76% of all Gross Merchandise Value (GMV) is owned by the top four companies, three of which are fighting over “last-mile delivery.”

This area will continue to be a bloodbath as Amazon, Uber, and other well funded start ups fight for dominance of this space.

The fastest growing marketplace is Faire, which connects brands with wholesale buyers.

As much as the DTC movement has grown, the value of distribution is still massive. For small brands, getting into retail and finding wholesale buyers can be incredibly difficult and Faire is bridging this gap. It just goes to show that while DTC is an incredibly valuable tool, it is just that, a tool. What’s most important early on is sales, no matter the source.

Other Notable Links:

1. Inside Mark Zuckerberg’s lost notebook – WIRED

2. Amazon is cutting ties with many couriers, trying to bring more shipping in house – TRANSPORTATION TOPICS

3. Facebook delivers long awaited trove of data to outside researchers – WSJ

4. Jeff Bezos commits $10 Billion to fighting climate change – GEEK WIRE

Subscribe to MGR eCommerce Weekly and receive weekly news directly in your INBOX.