MGR Amazon Weekly Update | October 28, 2019

Top News This Week

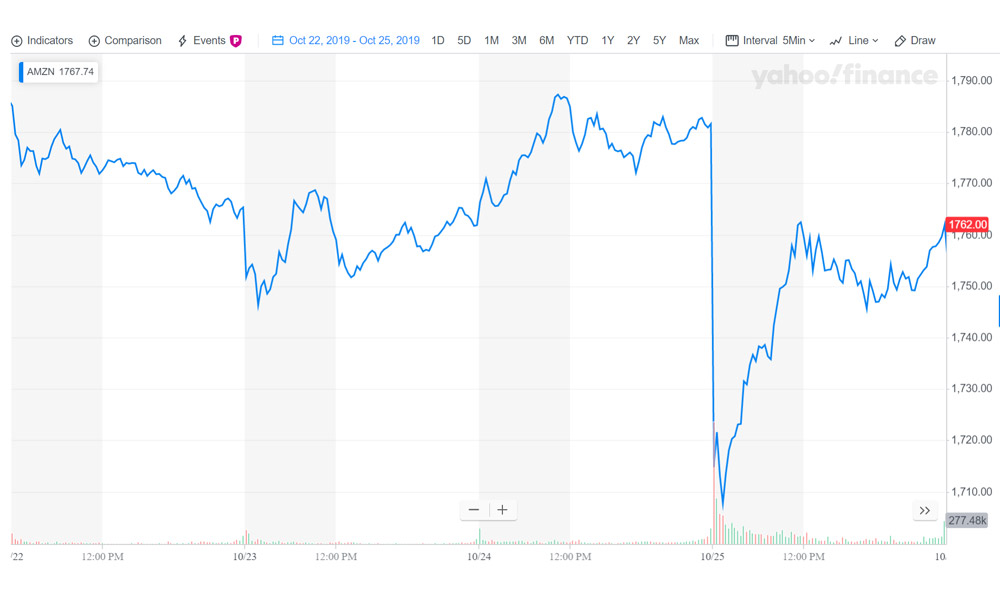

Amazon Reports Q3 Numbers, and They Are Not Good

Amazon reported a YoY increase in revenue, generating $70 billion. But, their profits were a major disappointment, bringing in just $2.1 billion, down 28% from Q3 last year.

What does this mean for sellers? Nothing for now.

Amazon has been a loss leader since its inception, neglecting profits is one of its core strategies, so them reporting low profits isn’t necessarily a shock, but it isn’t something shareholders are happy about. The profits mostly came from AWS, their cloud computing business, and their ads business. The reality is that Amazon.com itself, the monster that is responsible for the far majority of the company’s revenues doesn’t actually make much money. Especially now that they’ve switched to 1-day free shipping with Prime while keeping FBA fees for sellers the same.

The problem is that Amazon is committing billions to offer better shipping, decrease counterfeit goods, and to create a better back end platform for sellers, meaning that Amazon.com will continue to burn cash for the foreseeable future. The challenge is that Amazon has done all of this without raising fees for sellers, and it is certainly reasonable for sellers to wonder if Amazon will continue to eat these costs forever. But, Amazon finds themselves in a predicament as well, most sellers already operate on slim margins so if Amazon were to raise fees even a small amount many sellers may leave Amazon and opt to invest more in their own eCommerce store fronts instead. Nothing is changing yet, but sellers should certainly keep this in mind as we move forward.

As Top Line Revenue Continues to Grow Rapidly, Amazon is Expected to Pass Walmart as Largest Retailer by 2022

Despite (or thanks to) lagging profits, Amazon’s top line revenue shows no signs of slowing. Walmart revenue has been growing at about 3% YoY (roughly in line with inflation) while Amazon’s revenue is expected to continue to grow at 20%+ for years to come.

Amazon already dominates eCommerce in the US, their market share estimates range from 43%-48% of all US eCommerce spending. They will likely continue to own this massive slice of pie in eCommerce as the overall pie itself grows. But in addition Amazon is expanding and creating thousands of physical retail stores where they currently have a very small footing compared to Walmart. These factors all lead to them surpassing Walmart as retail commander and chief, and see revenues soar past the half a trillion mark.

Other Notable Links:

1. Amazon’s Chief of Consumer announces they are ready and willing to spend billions to put a stop to counterfeit goods on their platform – FOX BUSINESS

2. ‘Amazon Counter,’ they’re in-store pickup service, is set to expand to thousands of stores across the US – VENTURE BEAT

3. Amazon goes premium, launches a new high end gin brand in the UK – CNBC

4. What generation is your target market, and what do they care about most? – CAMPAIGN LIVE

Subscribe to The Edge Digest and receive weekly news directly in your INBOX.