If you follow our MGR Unplugged Podcast, you’ve probably heard us talk a few times about the current “growth at all costs” trend that seems to be the mantra for the majority of venture-backed startups.

This approach has been primarily based on increasing a company value through a combination of customer acquisition, strong branding campaigns, and social media exposure to name a few of the most commonly used tactics. In sum, a combination of vanity metrics that in reality add very little value to the companies’ balance sheets.

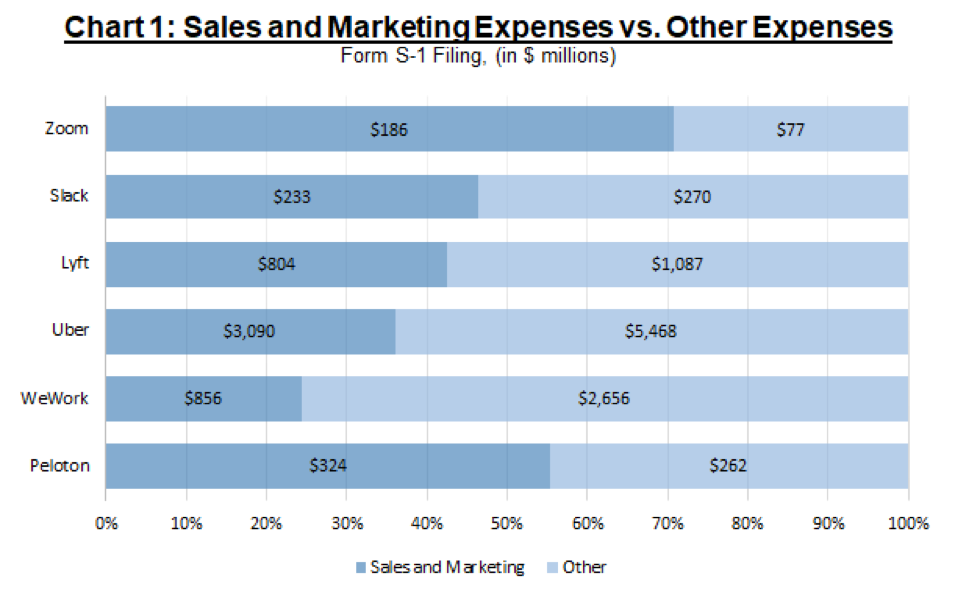

The part of the equation that doesn’t make headlines (at least until more recently questioned valuations) is the fact that the cost of acquiring customers at large scale through costly discount incentives combined with expensive advertising and social media campaigns create an often ignored collateral damage: acute burn rates.

When you’re spending significantly more money than you make, you’d better have a good amount of cash from large venture funds that believe what you believe. Being a “disruptor” with unicorn aspirations is certainly not cheap but even with a “growth at all costs” goal in mind, at some point, you have to start making money (or actually show profits) to convince your investors

The typical startup business plan banks on these three core stages:

- Aggressive growth to dominate the market and provide a sufficient lead against future competitors. That will also bring first-time customers that, once they become used to your brand, they will also absorb future rate increases for your service. Yes, you want to become a monopoly for as long as you can.

- Ability to scale. A business with no scalability is not a business and it has zero interest for investors.

- Long term vision that includes proof a viable and profitable business model for years to come.

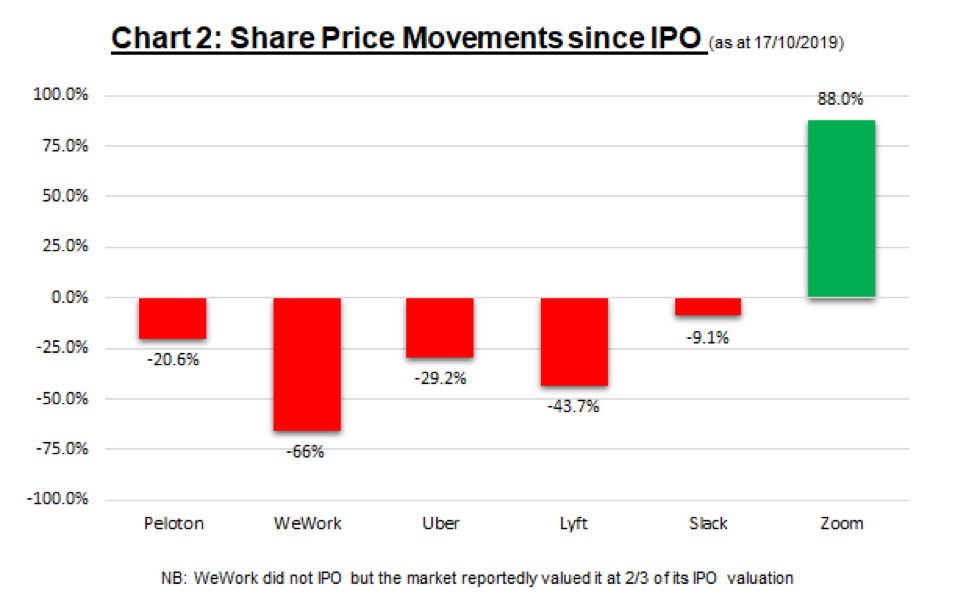

Needless to say, all of the above points are easier said than done. Specifically, when it comes to item #3, is when most companies simply fail to prove their worth. Very recently, WeWork ended up canceling their scheduled IPO when their initial valuation was heavily “devaluated” in the process. It turns out, that it may take up to 13.5 years for WeWork to break even per customer.

Once again, growth is a critical factor to attract investors and drive greater valuations, but as with any equation, you need more than one factor for the formula to work. Growth without profits can only take you so far. Regardless of your valuation methodology, when it comes to public markets, you still need to show positive results in common metrics such as gross margins, return on equity, and profitability.

As you can see in the above chart, only Zoom has made an actual profit at the time of the IPO. The other startups have added profitability warnings in their S-1 filing, with no clear pathway to profitability insight. For that same reason, all of them, except for Zoom, have seen their share prices decline even more since their IPO including WeWork that, as previously stated, didn’t even go public as planned.

In sum, when looking at investing in a startup company, growth is always good. Scalability is a must. Long term sustainability and proof of profitability will always attract investors. Which leads me to believe that the era of “growth at ALL costs” maybe coming to an end.

As always, if you need any assistance with your digital marketing, our MGR Team will be happy to chat with you one-on-one. Use this link to contact us and set up your free consultation.

Thank you for reading. Until next time, this is Manuel Gil del Real (MGR).

Sources:

CG Ventures, Bloomberg

Charts by CG Ventures

Photo by Austin Distel on Unsplash