Guest Post by:

|

Two protocols that are pushing the entire DeFi space forward

Welcome to this week’s Alpha Watch. We launched our podcast recently and have two episodes live! The first is a group discussion on where we discuss which L1s and L0s we think will do best in 2022, and the second was a debate between our own David Gil and Jordi Alexander, CIO of Selini Capital, on the merits of Olympus DAO.

We’ve got more great guests coming soon so subscribe if you haven’t already! You can watch on YouTube or listen on Spotify.

Hashflow: DeFi the way it should be

Hashflow is attempting to create a professional grade DeFi suite for traders and market makers.

As far as DeFi has come, in many ways it still remains in what will be looked at as these stone age era. Hashflow is building tools to move us forward to the iron age and beyond. They are doing this in a few ways:

- Full control over LP price ranges for market markers

- Permissionless market making pools, meaning anyone can create a pool and users can allocate capital to those with the best strategies

- Guaranteed price quotes that protect from front-running, sandwich attacks, and are gas optimized

- Spot, options, and futures trading

If Hashflow succeeds it will be the closest thing we have to institutional grade tooling, except it will be open to everyone.

In addition to operating on the Ethereum Mainnet, they’ve also just launched on Polygon to offer low fee trading, and are extending their current Beta through March.

Hashflow is launching their token ($HFT) once the Beta testing is complete, and you still have time to earn some if you participate in the platform Beta before it ends. They’ve allocated 6.75% of the supply for early users and participants, if you’re intested in trying it out, they wrote a Twitter thread on getting started here.

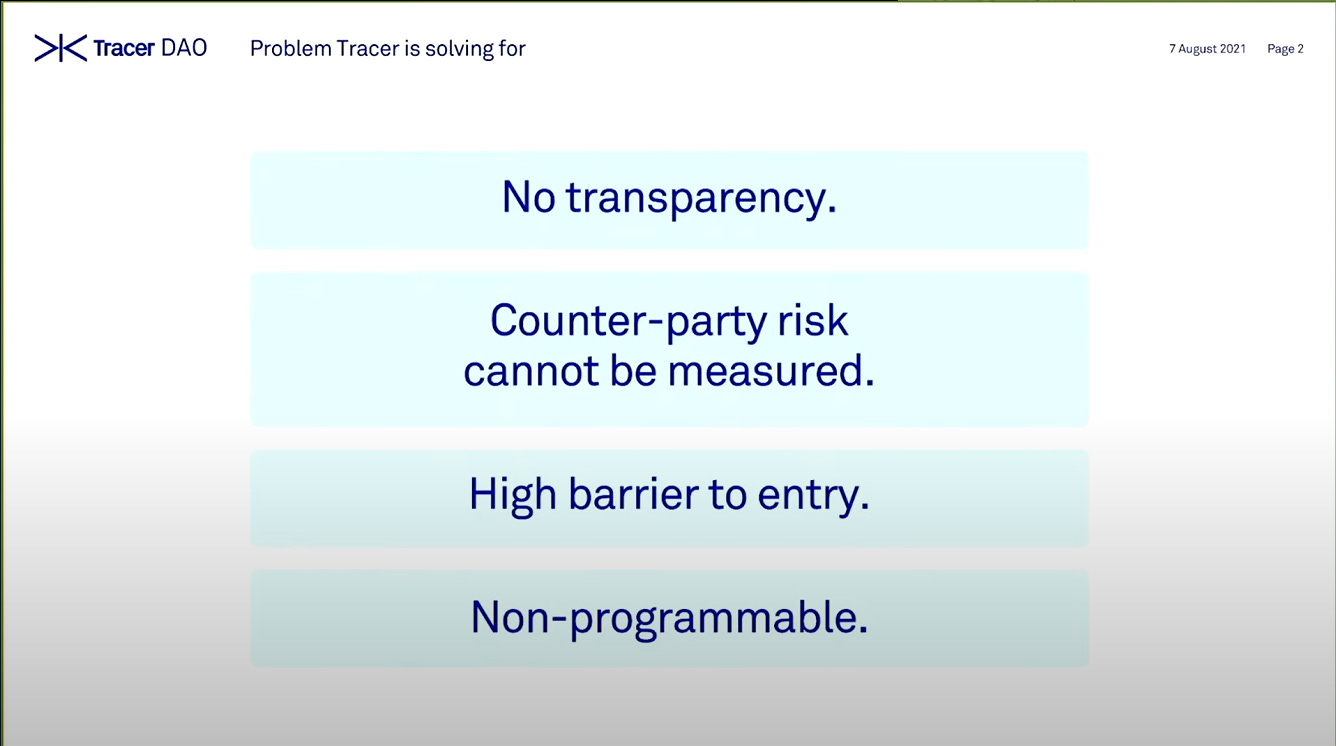

TracerDAO could revolutionize derivatives

TracerDAO is a derivatives platform that is aiming to become the ‘Apple Store’ of derivative markets.

By using their fully permissionless smart contracts, anybody can propose and utilize Tracer to deploy a new market. This financial sector continues to face huge adoption issues, stemming from a high barrier to entry (cost, time, bureacracy) and centralization.

This has created a massive silo where exchange data is maintained by a select few centralized exchanges, which poses security concerns and stalls innovation that has yet to be fully tapped into utilizing derivatives.

TracerDAO aims to solve three core problems that stem from this:

- Open system – remove risk with programmable liquidations

- Low barrier to entry – anyone has access to create and participate in derivatives

- Fully programable markets – increased possibilities of applications and markets built on top of TracerDAO. There contracts are already able to integrate with enterprise software used by fintech companies and neo-banking applications

How Tracer works

Tracer uses what they call ‘Tracer Factory’ which is their set of smart contracts that users can access to create their own derivative products.

These contracts are then added to the Factory where the template can be used and accessed by others. This open source environment ensures contract standardization, accessibility, and ease of market deployment. All of this is governed by the TracerDAO.

Use case example: Oracle gas risk

Chainlink is the largest node operators and also one of the largest gas consumers across the entire DeFi ecosystem. The protocol and others looking to scale have to manage their gas risk which is extremely unpredictable.

Tracer is currently working on a derivatives market where these operators would be able to lock in their gas prices and minimize their gas pricing risk.

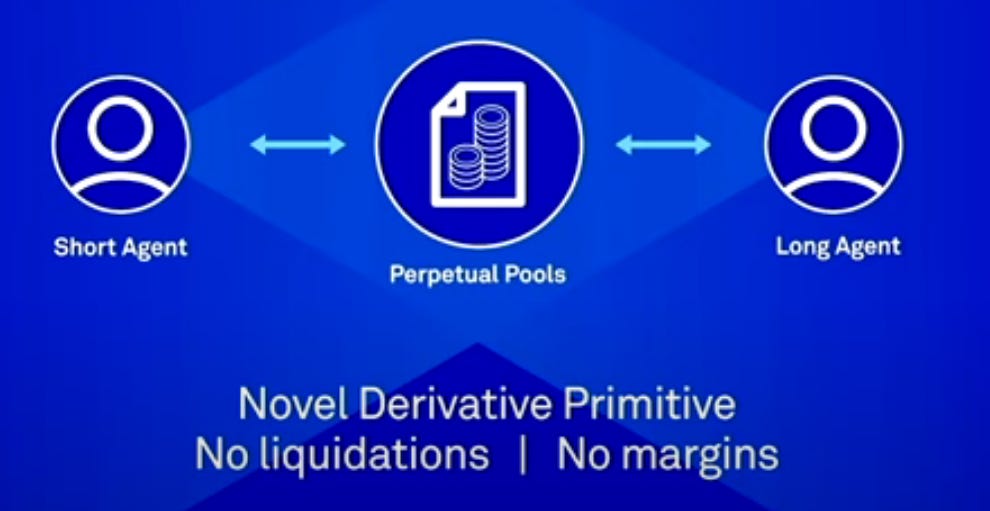

Perpetual Contracts Beta

TracerDAO is currently in the beta phase of their perpetual contracts platform where users face no risk of liquidation or margins. Perp contracts enable trillions of dollars of volume YoY, and is almost entirely limited to the crypto markets. Their long-term goal is to eventually integrate their platform with traditional derivatives markets.

As TracerDAO and Ethereum layer 2 protocols continue to gain adoption, the use cases Tracer could pioneer grows exponentially, and a project our team will closely be watching in 2022.

That’s all for this week, we’ll have a new podcast with an awesome special guest coming soon. Stay tuned!

Disclaimer: Defi Mafia and its contributors are not financial advisors and nothing you read should be considered financial advice. We often invest in many of the tokens, projects, and protocols we discuss. This both gives us skin in the game, but has potential to alter our bias, always keep this in mind when reading.