Guest Post by:

|

Greetings, we hope you’re all having a great first week of the year! It certainly started off with a bang as $NEAR, the topic of last week’s alpha watch has just hit new all time highs.

Let’s see if we can keep the hot streak going with the projects on our radar this week.

Vesta Finance: Lending We’ve Been Waiting For

Vesta is attempting to solve one of the largest growth barriers to all of DeFI:

Capital efficient lending.

While DeFi has seen tremendous innovation over the previous two years, capital efficient lending remains one of the biggest problems yet to be solved. Currently lending platforms such as Aave and Compound only offer highly over-collateralized lending up to 75% LTV, meaning for every $100 you put in, you can only borrow $75 against.

While this is great for traders and capital managers looking to maximize returns on their positions, it’s not practical for the majority of real world lending use cases.

The Vesta Solution

Vesta is looking to increase LTV standard to over 90%, as well as accept a broader range of DeFi assets. Unlike Aave or Compound, Vesta will issue its own stablecoin (VST) in exchange for collateral. We’ve seen this model work tremendously well for protocols like Terra and Abracadabra with UST and MIM.

By blending the Aave/Compound model with the Terra/Spell model, Vesta hopes to create an attractive new offering for DeFi users. VST is also attempting to be gas conscious, they will initially launch on Arbitrum and expand to other low fee L2s and potentially cheap L1 chains.

The first three assets being accepted as collateral will be ETH, renBTC, and gOHM. They also have plans to add CRV, CVX, FXS, and other popular DeFi tokens as voted by the community.

They announced on Monday they closed their angel round which was led by Crypto Twitter favorites @tetranode and @dcfgod. Vesta will launch later this month, and it is certainly a new DeFi entrant to watch closely.

New Order: The Butterfly Effect has Just Begun

New Order ($NEWO) is a DeFi project incubator, but instead of backed by VCs and operating behind closed doors, it’s operating as a DAO.

Their mission is to:

“Operate as a black hole for builders and entrepreneurs to create an ecosystem of interoperability.”

One could think of New Order as a decentralized Y Combinator.

The first of their ventures was [REDACTED] Cartel, a new entrant in the Curve Wars (We’ll be writing a deep dive on the Curve wars this week). [REDACTED] is a partner with Olympus using the same bonding mechanisms to raise money except the deposits accepted were CVX, CRV, and OHM.

This first venture has been a smashing success. They raised nearly $75M in their first round of bonding and have managed to grow the treasury to nearly $140M at the time of this writing. As a result, [REDACTED]’s $BTRFLY token has achieved a market cap of over $500M. All of this in the span of one month.

With this first launch, New Order has proven itself as not just a capable DAO, but one that could take the center stage of DeFi in 2022.

Quick note: You may be eligible for a $NEWO airdrop and not even know it. If you own any of the following you qualify: $BTRFLY, $OCEAN, $FLX, or $OPTY. Click here to claim.

Raini: A Gaming Unicorn in the Making?

Raini is one of the more under-discussed quality GameFi projects at the moment, but it may be time to start paying attention.

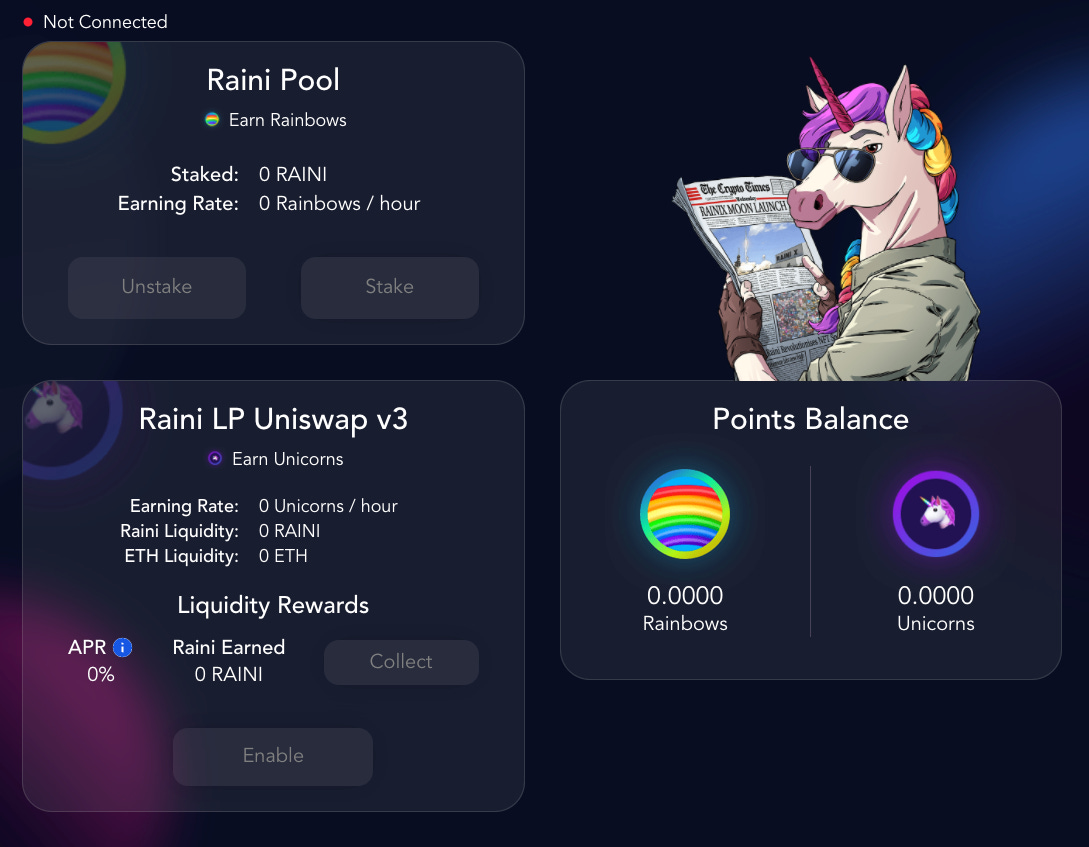

Raini is a highly ambitious project aiming to build a cross-chain NFT platform as well as a crypto gaming studio. The NFT platform is unique to other NFT marketplaces in that they’ve introduced a DeFi farming aspect it. Unlike other platforms such as OpenSea where users can pay for NFTs with ETH, USDC, or DAI, on Raini users pay with “Rainbows and Unicorns.”

The platform’s native tokens must be earned by purchasing $RAINI and either staking or adding to one of the RAINI LPs. While they are taking a risk on this model working over the traditional one, if it succeeds they will create immense buy pressure for the RAINI token by users looking to gain access to the platform.

What we’re even more excited about is their first game launch coming Q1 2022.

The Lords of Light is a turn-based card game similar to Hearthstone, which has north of 20 million players worldwide. Raini is hoping to take the concept of in-game purchasable cards and digital ownership to it.

See the trailer here:

You’ve waited, and now It’s finally time for #RTLOL to step into the light. HQ YouTube link: youtube.com/watch?v=ibl9bL…#NFTs #PlayToEarn #P2E #Ethereum #BSC #FTM

In a game like Hearthstone, players will spend hundreds if not thousands of dollars on cards in order to gain an advantage in game. All of that money goes to Blizzard (the studio behind Hearthstone) and once the cards are purchased they are not able to be resold.

By issuing their cards as player owned NFTs, Raini intends to change this.

Currently, the $RAINI token is sitting at a market cap of $32M, down 67% from its all time high during NFT-mania earlier this year. If Raini can pull off what they’re attempting to do there’s no reason it couldn’t reach a $100M market cap again, and possibly even beyond.

Liquid Driver: The Race for Fantom Liquidity is Heating Up

As the Curve Wars on Ethereum Mainnet continues on, the “Curve & Convex Model” is being quickly replicated across all chains. Yet another “Curve related” project that’s seen incredible gains since the November/December correction is $LQDR or Liquid Driver.

Liquid Driver is effectively the Convex of the Fantom Ecosystem, looking to swallow up tokens and guide liquidity to their LPs. On the other side of the coin (get it?), SpiritSwap has transitioned into the “Curve Model” of tokenomics, deploying a $SPIRIT/$inSPIRIT model where users or protocols can lock up Spirit tokens and vote on where to guide future liquidity rewards. Liquid Driver plans on acquiring as many of these voting rights tokens as they can.

@Deg3ntrades wrote a quality thread on his strategy of how to play this here:

That’s all for this week! Be sure to subscribe if you haven’t already to get weekly alpha in your inbox. If you enjoyed the read, we’d really appreciate if you could share our writings with some friends 🙂

As mentioned above, our next deep dive is coming later this week on the Curve Wars where we’ll discuss Cruve, Convex, and all the protocols vying for control. Stay tuned!

Disclaimer: Defi Mafia and its contributors are not financial advisors and nothing you read should be considered financial advice. We often invest in many of the tokens, projects, and protocols we discuss. This both gives us skin in the game, but has potential to alter our bias, always keep this in mind when reading.